5 Peter Lynch Quotes for Traders Seeking Success

January 13, 2018

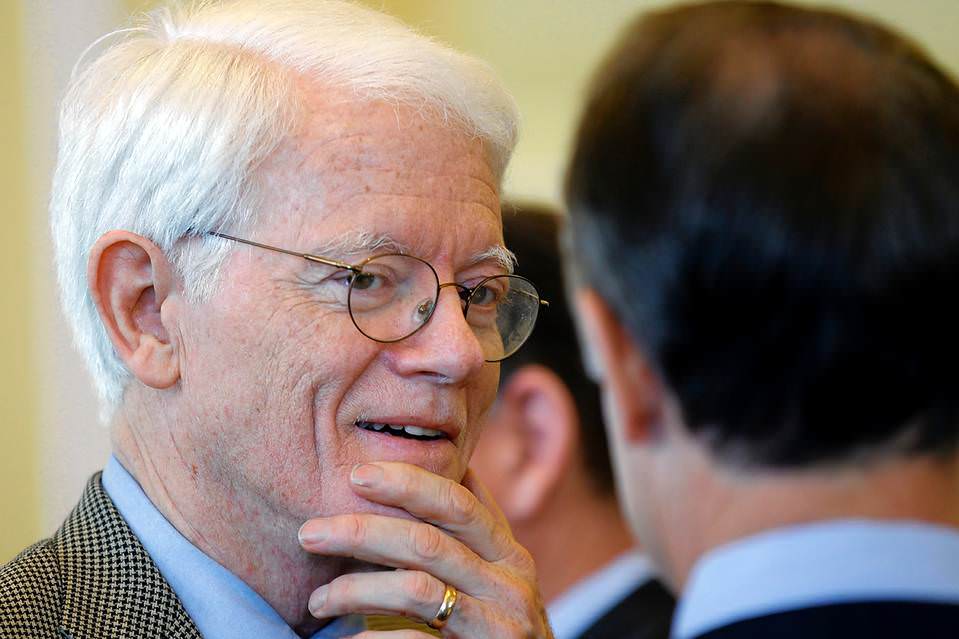

Peter Lynch is a famous stock investor. He was the director of Fidelity Investment's Magellan Fund, thanks to which he gained notoriety when he recorded an average of 29% annual returns for eleven out of thirteen years. By virtue of these incredible results, the fund grew from 20 million to 14 billion dollars. Peter Lynch differs from other investors not only in numbers but also in strategic approach. An approach that earned him the nickname "Chameleon": he collected the best of what the experts' landscape expressed at any given moment and made it his own, often changing strategy and frequently reshuffling the portfolio (intended as a basket of securities, of course).

Peter Lynch is also famous for the role of guru he has played in the past and still plays today. A role in which he definitively consecrated himself with the release of the book "One Up On Wall Street", followed by the equally effective "Beating the Street".

Many quotes are attributed to Peter Lynch, most of which exclusively concern the stock market. However, even from these, a lesson can be drawn for Forex traders. Here are the 5 most significant (and useful for Forex Traders) quotes by Peter Lynch.

Never invest in an idea you can't illustrate with a crayon

The original, to tell the truth, sounds like this "Never invest in any idea you can't illustrate with a crayon", which hides an idiomatic expression and is therefore not literally translatable.

The quote can be compared to Albert Einstein's famous aphorism "You do not really understand a subject until you are able to explain it to your grandmother". The meaning, while being different, has the same moral, the same underlying value: simplicity.

Peter Lynch came up with this aphorism during a meeting with children, elementary school students. As a joke, he asked them to "draw" what, for them, is a stock portfolio. The drawings depicted some brands they knew. Peter Lynch later realized that the stocks represented... were performing quite well! Obviously, this was a coincidence, but it represented the starting point for this suggestive quote. Very simply, the appeal is to simplicity. It is not necessary to get bogged down in complicated calculations or to look for the proverbial needle in a haystack to select the best stocks. The paradigm of simplicity also applies in the analysis phase: no complicated indicators that overlap one another. This is the lesson that Forex traders can take from this quote.

The best stock to buy may be the one you already own

The original reads "The best stock to buy may be the one you already own". Peter Lynch developed this quote during his early days as manager of the Magellan fund. He realized, in fact, that the stocks that initially seemed insignificant within the portfolio he found himself in front of at a certain point began to perform surprisingly well. The lesson to be drawn, for stock investors, is the following: it is not necessary to keep looking for the perfect stock, there is a high probability that one of these is already in your possession.

If we translate this quote, and the related lesson, into Forex Trading, what indication can be drawn? Simple: it is useless to go from pair to pair. The answer to the question: what is the best currency to trade? Could be: the one you are already investing in. Actually, it must be said, this is a question that mostly inexperienced traders, beginners, ask themselves. The experienced ones have already selected their preferred pairs and, possibly, have gained some experience in this regard... And they always stay on top of things. Sometimes they do it with swing trading, if in the short term the pair does not produce profits, but they always stay on the same course.

A sure cure for taking a stock for granted is a big drop in the price

The original is: "A sure cure for taking stock for granted is a big drop in the price". The meaning of this quote is evident. In a nutshell, big crashes throw in investors' faces a bitter truth: never take a stock for granted. The reference is to the humiliating experience that sooner or later all traders go through: they convince themselves that a stock will continue to rise, they let go, they stop studying it, and finally the "Mr. Market" catches them completely by surprise. A humiliating experience, both for the loss of money that one is inevitably forced to endure, and for the moral toll.

This is a lesson that is good for any type of trader, including Forex traders. It is not uncommon, in fact, to rest on one's laurels, perhaps after a nice winning streak. Perhaps one begins to experience feelings that are not functional to profitable trading, such as euphoria, excessive confidence in one's abilities. And, instead, it happens that sooner or later the market presents the bill, and punishes the investor for his superficial behavior. When this happens, it is good to stop licking one's wounds and immediately roll up one's sleeves.

When even the analysts are bored, it's time to start buying

The original is: "When even the analyst are bored, it's time to start buying". The meaning of this quote is not obvious. To understand it right away, it is necessary to know how analysts behave. In a nutshell, their interest is magnetized around the most famous stocks, and this is logical and understandable, or around those less famous but characterized by particular traits, by over-the-top performances in one sense or the other, especially in a negative sense. It follows that a healthy behavior, let's say of constant and balanced appreciation, is distinctive of the stocks that are little considered by analysts. This conviction proceeds from the fact that the media work in a certain way, and on TV as well as on the Internet as well as in newspapers, a falling tree makes more noise than a growing forest.

Obviously, this is an extreme view but still useful for orientation purposes. In Forex Trading, all this translates into the following indication: do not refer exclusively to the pairs most frequented by analysts, excellent opportunities are also found in less well-known pairs.

Behind every stock is a company. Find out what it's doing.

The original is: "Behing evert stock is a compant, find out what it's doing". The meaning of this aphorism is quite simple to understand. Lynch's is a very balanced statement, but it does not say anything new. Known, therefore, but not for this reason widespread. This simple and effective rule tends to be forgotten by investors. These, in fact, focus everything on technical analysis, which will certainly be a discipline capable of providing effective guidance, but which alone cannot go far. It is necessary to orient oneself with information, and specifically the information of the company behind a stock.

All this, translated into Forex trading, is nothing more than a warning to the right approach for analysis. Specifically, fundamental analysis. It is impossible to predict the price simply by studying the chart, even if we were in possession of the best indicators in the world. The only solution is to accompany the study of the chart with that of the external environment. It is therefore necessary to identify the market movers, then follow them and trade in relation to them. Interpretative skills are necessarily important, as well as a certain experience in the processing of news, but there is no other choice.