Technical Analysis of Moving Averages in Forex Trading: Types, Signals, and Strategies

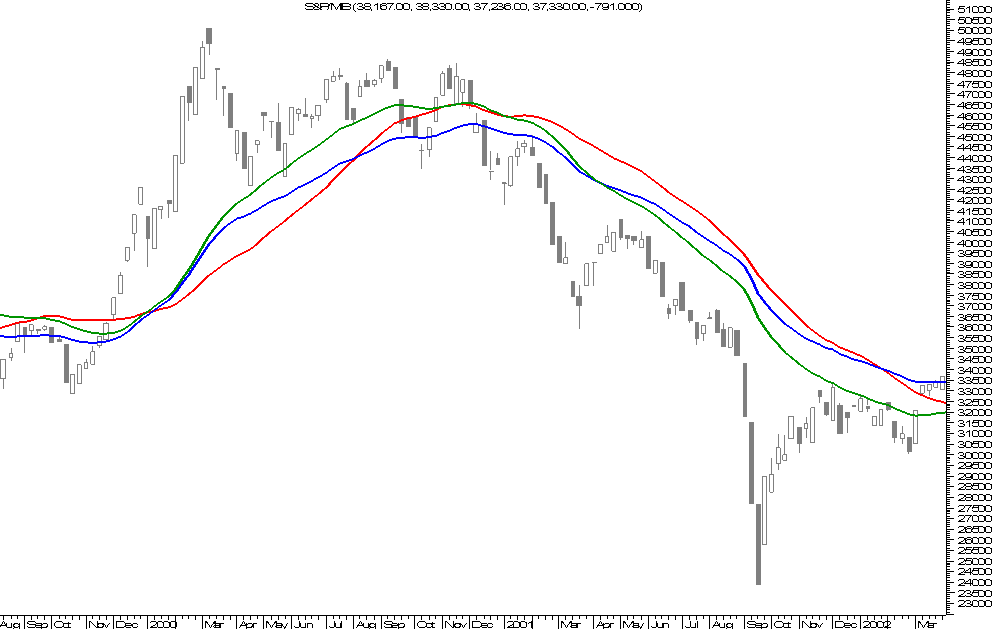

Technical analysis thrives on indicators, that's true. Traders often refer to indicators to derive signals, predict price movements, and organize their orders - hopefully - effectively. Yet technical analysis can also be performed by referring to elements that are, at least on paper, less complex. From this perspective, simplicity, or at least not excessive complexity, can only improve the prospects of victory and profit. The most used element by those who prefer a "lean" approach is represented by

moving averages. Moving averages themselves are financial tools, or better to say "technical analysis material", capable of adapting to any trading style. Below is an in-depth overview of moving averages, with a focus on types, signal reading methods, and the most common strategies.

Types of Moving Averages

But... What is a moving average? It can be defined as a line in which each point represents the average price recorded over a number of previous periods. It is "moving" because it is continuously updated, and gives the impression of moving along the chart.

Its original function is to

provide a broader view, and therefore usable in analysis, of any trends in progress. This is true because the moving average represents the price not at a given moment, but in relation (through the average dynamics) to what happened previously. The moving average, however, can also be used in the actual strategic phase, therefore as a source of signals. This happens in conjunction with the interaction with the current price, but there's more.

However, before exploring the concept of moving average in a strategic key, it is good to describe the various types of moving averages currently used.

SMA. An acronym for Simple Moving Average, it is translated into Italian as "media mobile semplice". The main characteristic of the SMA, or simple moving average, is the conferring of the same importance to each point of the average itself. Each price, therefore, regardless of the moment in which it was recorded, enjoys the same important "arithmetic". The SMA takes up the concept, known in statistics, of the simple average. Despite the acclaimed simplicity and the deliberate neglect of important information, it is widely used in the strategic phase. It is in fact the basic element of many strategies, although a certain doctrine considers these strategies not fully autonomous. In a nutshell, the signals derived from them should be confirmed by the use of other indicators.

WMA. An acronym for Weighted Moving Average, it is translated into Italian with the term "media mobile ponderata". The main characteristic of this moving average, and what clearly distinguishes it from the simple variant, is the assignment of different importance to each price. In a nutshell, in the moving average each price is worth "one", while in the WMA this value depends on how recent the price is. Greater weight is assigned to recent prices and less weight to less recent prices. The rate at which weights decrease is constant. The WMA is generally considered much more reliable than the SMA, if the goal is to implement complex strategies.

EMA. An acronym for Exponential Moving Average, in Italian it is known as "media mobile esponenziale". Just like the WMA, it assigns a different weight to prices based on how recent they are. Just like the WMA, it assigns greater weight to "new" prices rather than old ones. Between the two averages, however, there is an important difference, which generates remarkable consequences from a strategic point of view.

The rate at which the EMA assigns weights is not constant, but exponential. For this reason, the EMA is considered to be the moving average that is certainly the most difficult to deal with, but also the most effective as it is capable of giving a more realistic and useful representation of prices. Another remarkable characteristic is the following: the EMA, unlike the SMA and WMA, is very difficult to reproduce manually. The only way to represent it is to rely on the computing capacity of a computer. However, all platforms offer moving averages ready-made, so it can be said that the problem does not arise.

However, there is another criterion on the basis of which moving averages can be qualified:

speed. With the term "speed", very simply, we indicate the number of periods that form the moving average, i.e. the number of "prices" taken into consideration. There are fast moving averages, which are generally at 13 periods; "medium" moving averages, which are at 26; and slow moving averages which generally reach 52 periods.

General Advice on Moving Averages

The first piece of advice is to avoid using moving averages during periods of higher volatility. This advice is valid because, when the price is volatile, the moving average and the price cross more often than they should and this generates false signals. If the volatility lasts for a long time, and it is therefore not possible to wait, the only alternative to avoid false signals is to use extremely long moving averages with a fairly wide frame. In general, a moving average capable of covering at least a quarter is considered able to cope with a context of average volatility.

The second piece of advice is to use moving averages as a tool for identifying Stop Losses and Take Profits.

Specifically, the Stop Loss in a long position should be placed just below the point of contact between the moving average and the price, and if the trend is bearish. It should be remembered, however, that "MAs" are excellent as a mobile support, but only if the position is medium-short term and the average is sufficiently slow.

The Take Profit, on the other hand, should be positioned near the intersection between the price and a moving average, provided that the latter is particularly fast.

It must be said, however, that moving averages are not the best tools for setting the Stop Loss and Take Profit. In reality, highs and lows are more effective - and simple to use.

Moving averages, in fact, are more effective as

market entry signals, rather than exit signals. Here, then, are the entry signals.

- When the price breaks through the moving average from the bottom up in the daily chart, an intraday buy signal is obtained.

- When the price approaches the moving average, touches it and then rebounds while still remaining above it, a buy signal is obtained.

- When a fast moving average crosses a slow moving average from the bottom up, a sell signal is obtained.

- When a long moving average crosses a fast moving average from top to bottom, a sell signal is obtained.

A final piece of advice is to pay close attention to the time horizon to be applied to the moving average. In fact, it depends on the trading style. If the trading is daily, the moving average should cover about 5 days. If the trading is weekly, it is good to consider a coverage of 50-100 days. If the trading is long-term, then it is better to choose a coverage of 100 or 200 days.

Strategies with Exponential Moving Averages

Before proceeding with the description of the strategies, it is necessary to make a clarification. The WMA and EMA can be considered interchangeable. So the strategies that apply to one also apply to the other. Obviously, as specified previously, EMAs are more accurate and more reliable, which is why they are almost always preferred to WMAs.

However, here are some strategies that feature exponential moving averages.

5-Day EMA Strategy. The 5-day moving average, which is extremely fast, suffers from the atavistic defect of all fast moving averages: to be really effective, it must be used simultaneously with other indicators. Obviously, the faster the average, the stronger this need is. Having said that, it can be stated that the 5-day EMA is useful for positioning the take profit. Furthermore, when it comes into contact with the price, it provides entry signals, regardless of the direction in which the contact occurred (from top to bottom, from bottom to top), regardless of the nature of the position (long or short).

The 5-day EMA reveals its true usefulness when used in conjunction with slow moving averages. Specifically, it suggests the exact moment to exit a profitable position. If the position is profitable and the 5-day EMA is crossed from top to bottom by the slow EMA, then it is good to exit the market.

Finally, a recommendation: it is good to give up the 5-day EMA when the market is volatile. In this case, in fact, the average is crossed continuously, generating an excessive amount of false signals.

10-Day EMA Strategy. This strategy is effective if you practice daily trading. It is mainly used in trend following approaches, as it allows you to operate in the correct direction. The signals it provides mainly concern entering the market. The 10-day EMA suggests a long position when it is crossed from top to bottom by the price. Nevertheless, the 10-day EMA provides sell signals. This happens when the crossover develops from the bottom up.

The 10-day EMA is reliable even on its own but it is always good to confirm the signals by resorting to some indicators. The reference is to those indicators capable of identifying any levels of overbought and oversold. An example? The RSI. The objective, in fact, is to recognize and avoid false signals. All normal, given that the 10-day EMA still remains a fast moving average.

21-Day EMA Strategy. It is a particular moving average as it marks the watershed between a fast and a slow average. It is excellent when pullbacks occur, as it is "slow enough" not to transform temporary retracements into signals of trend reversal, a phenomenon that often occurs when moving averages are very fast. This implies that the 21-day EMA is crossed less frequently, and that therefore each crossover cannot and must not go unnoticed. This characteristic of it - the inelasticity to pullbacks - makes it particularly effective in very short-term trading, at the limit of scalping. For approaches with a wider scope, it is always useful although the simultaneous use of indicators capable of returning data on volumes is recommended.

Strategies with Simple Moving Averages

50-Day SMA Strategy. It is a fairly slow moving average although not very slow. Despite falling into the "simple" category, it is one of the preferred tools of more experienced traders. Its main characteristic, in fact, is the ability to identify the phases of accumulation and distribution. It is no coincidence that the 50-day moving average tends to stay, once pierced, for a long time above or below the price. It is used, therefore, to understand what the real intentions of institutional investors are, who are the main architects, given the enormous liquidity they put into play, of the accumulation and distribution phases.

For the rest, it works exactly like the other moving averages: if used in conjunction with moving averages of different pace, it generates fairly reliable entry and exit signals. An example? If used with the 10-day EMA, which is a fast average, it offers an entry signal when it is stably below the price and the latter crosses the same 10-day EMA from the bottom up. The sell signal is generated in exactly the opposite way.

Finally, the role of mobile support/resistance of the 50-day SMA should be noted. The reason? Simple, this type of medium, slow but not very slow, gives its best when the trend is strong. By some it is even recommended as a better indicator, always in case of a consolidated trend, of the RSI. Surely, its use is recommended to beginners, who find themselves more at ease working on an average than on a complex indicator as is, precisely, the RSI.

100-Day SMA Strategy. We are faced with one of the slowest moving averages ever. It is generally very sensitive to price, since it takes into consideration very long periods and, moreover, not weighted by a varied and realistic assignment of weight. For this reason, it is always very far from the price period. It follows that, in case of a crossover, which to tell the truth is quite rare, the trader must draw a very strong signal of trend reversal. Generally no confirmations are needed but the most scrupulous take a look at the RSI. In these cases, the RSI signals very high levels of overbought and oversold, and this is nothing more than a reconfirmation of the signal already provided previously by the 100-day simple moving average.

Occasionally, if the trend is very strong, the 100-day SMA can be read as if it were a mobile support/resistance. However, since it is very far from the price, it should be taken into consideration - if this so-called pivot function is assigned to it - for medium or long-term trading.

200-Day SMA Strategy. It is the longest average ever. It is therefore suitable for long-term traders. However, it has an important role in shorter approaches. A fairly established rule is that you should never open a long position if the 200-day SMA is above the price. This is however obvious, almost pleonastic since a 200-day SMA above the price means that we are in a full bearish trend. Similarly, it is really not recommended to open a short position if the 200-day SMA is below the price, as it means that the current trend is bullish.

Being a very slow average, any interaction with the price announces, with a very high degree of reliability, a trend reversal. It is a rare event, and when it occurs, traders - unless they are really inexperienced - never stay idle.

Another extremely reliable entry signal is the following: the price crosses the SMA in a bullish direction, approaches the average one last time and then continues on its way, moving away. It is the signal that the price has broken down the last resistances and is literally taking off.