Officially,

Forex Trading has no set hours. In fact, the foreign exchange market is one of the few markets open 24 hours a day. Obviously, it does observe periods of closure, specifically during weekends. In general, however, it can be said that it is "always open." This is a significant opportunity, as it equates to a greater number of opportunities to exploit. However, this does not mean that one time is as good as another. Depending on the active stock exchange sessions, and especially the overlaps, Forex Trading can be more or less participated in and, above all, more or less volatile.

The three sessions

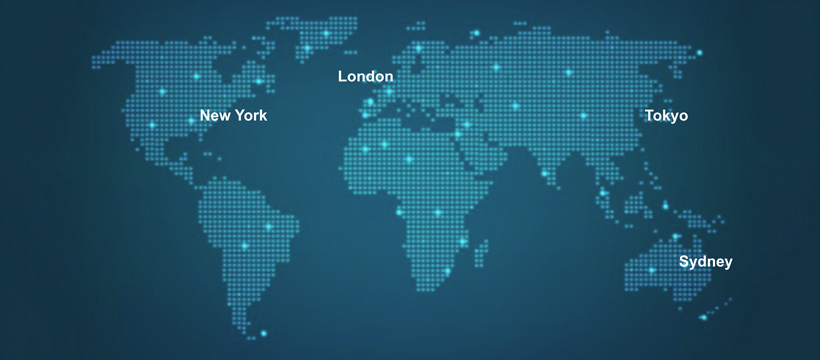

Forex Trading is heavily influenced by the stock markets, i.e., the exchanges that take place in the main global markets. Therefore, when a session is active, elements that can serve as a starting point for traders arrive from them, and consequently, they crowd the foreign exchange market with more or less vigor, causing a certain tendency towards volatility.

The Asian session. This corresponds to the markets of Tokyo, Singapore, and Sydney. Depending on Italian daylight saving/standard time, it can start at 23:00-00:00 and end at 10:00-11:00. Generally, not much happens during this time slot, and both in the stock market and in the foreign exchange market, investors try to consolidate their positions. Moreover, the number of participants is low. The result is minimal volatility, and unless there is shocking and sudden news to discount, prices always vary little.

The European session. This corresponds to the markets of Frankfurt, Milan, Paris, and Madrid. Depending on daylight saving/standard time, it starts at 08:00-09:00 and ends at 17:00-19:00. In this time slot, the game starts to get interesting. The number of participants in the respective markets increases, economic news is released that can act as market movers, and stocks rise and fall. All this, of course, has a heavy impact on Forex and specifically an increase in volatility that is noticeable, at least compared to the Asian "tranquility."

The American session. This mainly corresponds to the New York market, which is considered the most important of all. Depending on daylight saving/standard time, it can start at 14:00-15:00 and end at 22:00. It is a crucial moment for all markets, not just the stock market. In fact, it is usually during the American session that the "games are played," i.e., the trends that need to be confirmed are confirmed, and the trends that need to be reversed are reversed. If the Asian session is for consolidation and the European session is for positioning, the American session can be defined as for definition. Obviously, all this is true from an ideal-typical point of view. In reality, anything can happen at any time. However, volatility is very high at the beginning, until it tapers off towards the end of the session.

Volatility and overlaps

As we have seen, each session corresponds to its degree of volatility. However, if you want to talk about volatility in Forex, you necessarily have to talk about overlaps. In fact, it is during session overlaps that the most interesting movements and the most significant increases in volatility occur.

The Asia-Europe overlap. This overlap, which effectively occurs at the opening of the European stock exchange, when the two continents intersect, is characterized by sui generis movements. In fact, there is a sudden increase in the number of participants, and it goes from dead calm to frenzy. The foreign exchange market (as well as the others) becomes, at least for an hour, very volatile. However, the number of participants is not so high as to "sustain" the price movements. The result is a greater risk of false signals. Investors who intend to trade on the wave of the Asia-Europe overlap must take these into account.

The Europe-USA overlap. In this time span, which lasts at least a couple of hours, the market reaches its maximum, i.e., the peak in both the volume of trades and the number of participants. Volatility, at least in the initial phases of the overlap, is extremely high. At the same time, however, it is sustained precisely by the participation rate. The risk of false signals, therefore, at least from an ideal-typical point of view, is lower than the Asia-Europe intersection. Moreover, the signals are supported by the market movers that, starting from the morning, direct the exchanges and offer concrete points.

In general, therefore, it can be stated that the moments of maximum volatility in Forex Trading always occur at the

opening of the European stock exchanges, when the Europe-Asia sessions intersect; and at the

opening of the New York stock exchange, when the European and Asian sessions intersect. However, in order to avoid the risks of false signals, it is best to favor the latter overlap.