How Leverage Works in Forex Trading

May 8, 2017

Leverage in Forex Trading is a widely used tool due to its main characteristic: the ability to exponentially increase profits. Nevertheless, it is a double-edged sword, capable of causing considerable damage to those who use it improperly. Here's what leverage is in Forex Trading, how it's used, and the pros and cons.

Financial Leverage: What It Really Is

Officially, financial leverage was created to allow investors to speculate with a greater intensity than what is permitted with their available capital. It was subsequently integrated by brokers, who thus contributed to bringing leverage into Forex Trading.

But what is it specifically?

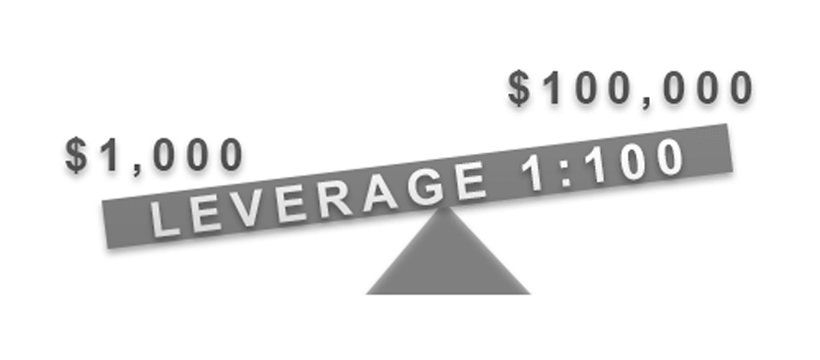

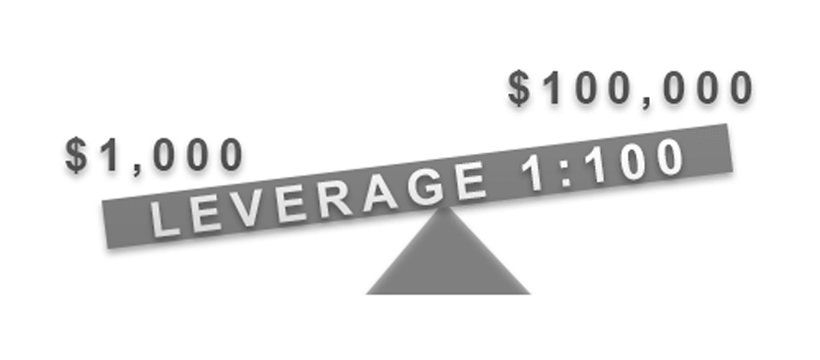

It is the tool that allows traders to move large sums despite a low initial investment. The ratio between the capital moved and the actual investment is represented by a ratio. If the leverage has a ratio of 1:10, for example, and the trader invests 1, they will earn as if they were investing 10.

Unfortunately, this also applies to losses. It is therefore clear why leverage is a double-edged sword: it increases potential gains, but at the same time, it also increases potential losses.

How to Use Leverage

Many brokers advertise the possibility of using leverage. Often, the potential for earning is highlighted, while the potential for losing (and a lot) is given little space. Of course, it's all logical, as it's marketing. However, it is not equally logical for traders to use leverage recklessly, without considering the consequences.

As with all things in life, and trading is no exception, it is necessary to proceed with moderation. Leverage is fine, as long as it is not extremely high. The perfect leverage is 1:10, although conventionally, a leverage of up to 1:50 is considered tolerable. If the trader is particularly experienced, however, nothing prevents them from trying even high leverage. You can even see leverages of 1:600 around.

In any case, it is always a good idea to associate the use of leverage with the placement of a stop loss. In this way, regardless of the leverage, the trade will stop when a given loss is reached. Obviously, it is necessary to make all the relevant assessments regarding one's financial possibilities and economic tolerance threshold. It should be noted that the broker does not allow losses greater than the amount held in the account....