This article will analyze a phenomenon that is much discussed and feared by retail traders: the false breakout. We will provide clarifications on what it is, explain its main effects, and how to learn to recognize it to protect your trading.

What are false breakouts

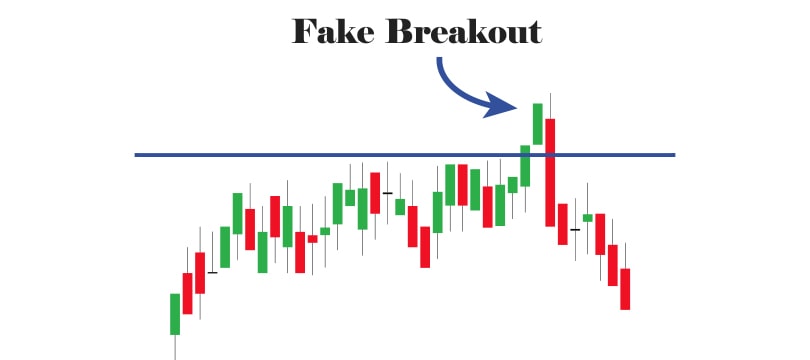

A false breakout occurs when the price of an asset exceeds a significant technical level (such as a resistance, support, trendline, or consolidated chart pattern) but instead of continuing in the expected direction, it quickly reverses, canceling out the initial movement.

This dynamic is not random. In most cases, it is the result of manipulation or intervention by so-called institutional traders, who have liquidity far superior to that of retail traders. After all, the goal of institutional traders is often to exploit areas with a high concentration of pending orders to obtain favorable entry conditions and improve their position. They can do it... And they do.

From a technical perspective, false breakouts are often caused by a combination of factors.

-

Low liquidity at breakout moments, which makes it easy for large operators to push the price beyond a threshold and then reverse direction.

-

Concentration of pending orders near technical levels visible and shared by many traders, which become a "target" for those who have the ability to manipulate the market.

-

Algorithmic strategies that act automatically when certain levels are exceeded, generating sudden movements not always supported by real volumes.

The false breakout is therefore a technical event that hides very precise strategic and behavioral logics. All elements that must be understood to avoid recurring traps.

The damage of false breakouts

A false breakout can produce significant consequences, especially for retail traders who operate with mechanical logic or without adequate risk management. Here are the main repercussions.

-

Direct economic loss. The first negative effect is the financial loss due to the position opened at the wrong time. A trader can go long on a resistance break, or short on a support break, only to find the price re-entering the previous range, triggering the stop loss or forcing a manual closing at a loss.

-

Compromising confidence in the system. After a series of false breakouts, many traders begin to doubt the validity of their technical signals. This can lead to a decrease in confidence in one's strategies, an operational paralysis, or, even worse, a vindictive attitude towards the market, which leads to impulsive decisions.

-

Increased emotional volatility. False breakouts can amplify psychological stress, especially in those who have not yet developed a consolidated operational discipline. Entering a position, seeing a momentary gain turn into a sudden loss, generates frustration and can trigger irrational reactions, such as revenge trading or oversizing future positions.

How to recognize false breakouts

Recognizing a false breakout in real-time is not easy, but possible. In fact, there are recurring signals that can help identify them with greater probability. These are technical and behavioral clues that, if carefully observed, allow us to distinguish between a real break and a speculative maneuver.

-

Contradictory volume. An authentic breakout is generally accompanied by a significant increase in volumes. If the price exceeds a key level but the volume remains low or decreasing, it is likely to be an artificial movement. The divergence between price and volume is one of the clearest signals of a possible manipulation.

-

Candle closing below (or above) the key level. A false breakout often manifests itself with a candle that breaks the level during its formation, but then closes below (for bullish breakouts) or above (for bearish breakouts) the technical threshold. This behavior signals a re-entry of the price within the range, highlighting the lack of strength in the breakout.

-

Absence of follow-through. In a real breakout, the breaking of a level is followed by a continuous movement in the same direction. If after the breakout the price immediately returns or remains stationary in a narrow range, without continuing in the expected direction, it is likely to draw a false breakout.

-

Presence of pronounced shadows. Very long candle shadows near key levels are often a sign of price rejection. In particular, when a candle with a long upper shadow above a resistance (or a long lower shadow below a support) is observed, it means that the market has tested that level but has not been able to maintain it.

What to do during a false breakout

When a false breakout is suspected or underway, it is important to take timely and rational measures to limit damage and possibly exploit the situation to one's advantage.

-

Do not anticipate, but wait for confirmation. In the breakout phase, whether true or false, it is always prudent to wait for the candle to close above or below the key level before entering a position. This simple precaution allows you to avoid many false signals due to temporary movements.

-

Use smart pending orders. Rather than entering the market on the break, it may be useful to place limit entry orders just above or below the level, but conditioned on confirmation of the breakout with solid closing and sustained volumes. Alternatively, stop orders with time or volatility filters can be used.

-

React promptly to the price returning to the range. If you enter a position on a breakout and the price re-enters the range in a decisive and fast way, it is advisable to immediately close the position. Waiting for a favorable return in these cases exposes you to a high risk without solid technical justifications.

-

Evaluate possible counter-trend operations. In some cases, the false breakout can offer a trading opportunity in the opposite direction, exploiting the price rejection. However, this type of operation requires considerable experience and ability to read the market in real-time.