Overcoming Panic Selling: Turning Crisis into Opportunity

September 7, 2021

Panic Selling is a seemingly dramatic event where certainties waver, and the market appears to be in a chaotic state. Indeed, these dynamics occur with some regularity. However, this does not negate the possibility of defending oneself against panic selling, surviving it more or less unscathed, and even profiting from it under certain conditions.

In this article, we approach the topic of panic selling from a proactive perspective. We will provide tips for overcoming this phase without collateral damage, illustrate some approaches to avoid getting caught up in the spiral of devaluations, and finally, discuss the opportunities that panic selling sometimes creates and how to exploit them.

Defining Panic Selling

The concept of panic selling is familiar to many, even outside the financial context. It could be defined as a commonly used expression, often cited by the media. However, it is essential to provide a definition that is as technical as possible while still being "understandable" to laypeople.

Panic selling is a phenomenon that frequently occurs in financial markets, characterized by the compulsive and time-limited selling of one or more assets.

During panic selling, an incredibly high number of traders essentially dump their securities, generating a significant drop in prices. This phenomenon is generally not justified by specific events or an actual loss of asset value. Or, to put it better, the beginning of panic selling is technically justified - the spark that ignites the explosion. The rest is, indeed, panic, or rather, emotional and irrational behavior.

Panic selling occurs in virtually all markets. However, some are more susceptible than others. The reference is to more speculative markets, where investors often consider the perception of strength as a decision-making tool. Now, the perception of strength can be compromised even by events with intense symbolic significance, such as an out-of-place statement, an out-of-place news item, and, when panic selling is in full swing, the simple observation that everyone is "selling."

Panic selling typically leaves casualties in its wake. After all, devaluations can be almost complete. It is not uncommon to witness collapses of several dozen percentage points. However, panic selling can also be considered a wave. So... it passes. Once the emotional wave has subsided, securities begin to recover. Those that are healthy and had little technical reason to crash recover completely.

Surviving Panic Selling

Panic selling is never good news. At best, it's a nuisance. At worst, it's a concrete risk and an equally concrete threat. This is especially true when it engulfs assets the trader has in their portfolio or on which currently open positions rest.

What to do in these cases? Well, there are two paths, and they can be implemented, if not simultaneously, then one after the other.

Exiting the market. This is certainly the most prudent measure. As soon as you sense that panic selling is starting, close the position by selling. This way, you'll likely leave something on the table, but you'll still limit the damage. Even though panic selling is a time-limited phenomenon, that time is enough to cause significant harm and realize heavy devaluations.

Waiting. The other path consists of simply waiting. In other words, avoid entering the market until the panic selling has passed. This can be a problem, especially if it contradicts your strategy, but it is still a precaution worth taking. If you're already "in," avoid exiting.

Turning Panic Selling into an Opportunity

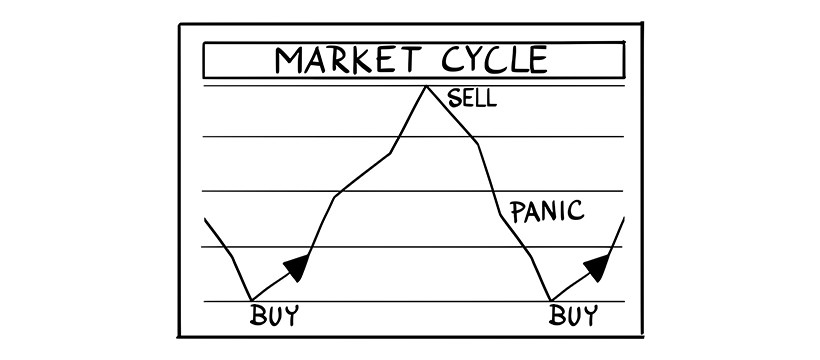

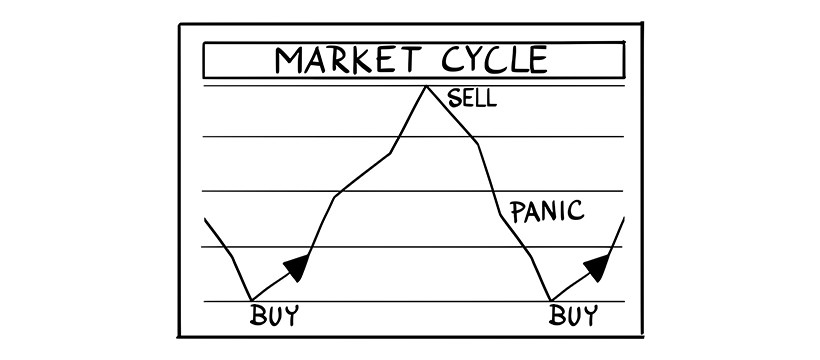

Panic selling can also be an opportunity. It seems strange, after all, we're talking about a very dangerous phenomenon with a chaotic nature that is essentially driven by irrationality. Yet, under certain conditions, it can favor the generation of rich surpluses. Obviously, at the heart of the matter is the rebound effect. All assets involved in panic selling, sooner or later, are subject to some rebound effect. They can't go down indefinitely or to zero, except in very rare cases. Specifically, the idea is to buy just before the turning point, and sell only when the asset has recovered or just before the exhaustion of the propulsive thrust.

Basically, this is a very complicated approach as it requires almost extreme timing. It is necessary to be able to sense the exact moment when the panic is "ending." It also requires a certain amount of courage because it requires buying when everyone is still selling.

Some conditions favor using panic selling as an opportunity to profit. Namely, the sales should proceed in a somewhat standard, regular way. Only in this way is the breakout, i.e., the change of direction, at least slightly visible. Incidentally, if this condition occurs, oversold levels can signal the end of selling and, therefore, the imminent rise in prices in a "more or less reliable" manner.

It bears repeating: turning panic selling into a profit opportunity is by no means simple. Those without a certain amount of experience should refrain. However, those interested can practice. How? Simple: by using backtesting programs. Simulating participation under panic selling is useful for "training" to identify the breakout point and thus develop skills that are helpful when facing a real panic selling situation.